How the Economy Impacts Real Estate Business

In the early days of COVID, many did not know what the outcome would be on the economy or the real estate industry in general. The consensus was that when the first round of stimulus burned off, more pain would come. The assumption was that as a result, better buying opportunities would come. But as many of us have seen, quite the opposite has occurred. And with so much conflicting information in the news, it's hard to tell what's going on.

It's safe to say that most Americans have spent countless hours trying to digest a lot of the media's information and trying to see if we are on the best course. In this article, we will dig into what we see in the commercial real estate industry and what you should look out for.

What affects the government continuing to pump in and print money has on the economy.

Slow Administration of the COVID Vaccine

On a positive note, we are beginning to see the light at the end of the tunnel with the COVID vaccine administration. But with only 7.7% to date administered, we have a long way to go. Along with that, there are disparities in vaccine administration along state lines. For example, based on what we have seen in U.S. Census data and the area’s most relevant to the JB2 Investments team, Oklahoma is in 4th place, with 11.3 % of the population receiving the vaccine to date. California is in the last place, with only 5.4% of the adult population now vaccinated or have received at least their first injection. We remain hopeful that the end will be in sight by the end of the summer.

Then the question is how does all this government stimulus and intervention affect us? The added amount of dollars in the economy coupled with an extreme amount of debt will inevitably bring about inflation. The Federal Reserve board target has longtime been 2%, but Jerome Powell has indicated that the FED will now be targeting above 2%. Some experts out there, however, suggest it will be closer to 3% or more.

What does Inflation mean for us as Real Estate Investors?

When it comes to real estate, it becomes a hedge against inflation. There are a handful of things that inflation does to real estate. For example, it erodes the debt. We mean that since the dollar has less buying power, it means even that debt will gradually reduce in value. It hurts the value of the cash that savers have in the bank. So essentially, we need to think counterintuitively and look at money as liability and debt as an asset.

With today's historically low rates, the rate of inflation acts as a wash against those low rates, and therefore it acts as free money. Prices will inflate as well. So, anyone holding real estate today will benefit from erosion of the fixed debt and an increase in the property's value. In the case of apartments, that also means inflation in rents. So, our cash flow will increase as debt is eroded and the property's value is increased. Further, the government will use inflation to erode the public debt that it is currently incurring. Based on the above information, we feel that it will be prime time to purchase property for the long term within the next one to three years.

Something else to keep an eye on is migration and demographic trends. As we all know, COVID and the rise of the work-from-home workforce have accelerated some of these trends. We are seeing many people move from expensive primary markets or from urban to more suburban areas. There is proof of that from data that U-Haul just came out with.

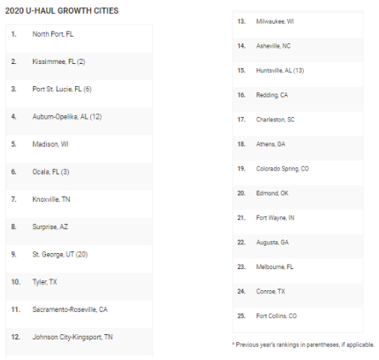

In the chart below, all these cities are secondary or tertiary markets. In 20th place on this list is Edmond, Oklahoma, a city located within the OKC metro. So, you see migration trends to more affordable markets. We have seen some rent increases in the OKC market due to this effect.

Some of these higher growth areas include Texas, The Southeast, and Florida. Part of the question is when COVID is under control, will these migration patterns continue at the same rate, or will they begin to subside? All in all, these migration patterns will be something we keep a close eye on. We also need to watch the regions that are the recipients of this migration.

The last big factor we would like to discuss is what is going on with demographics. One demographic that has not been highly debated is the young adults 18 to 29 age group. The young are living with their parents at higher rates not seen since the great depression. At JB2 Investments, we have some anecdotal evidence of this, having brothers in that age range that live with our parents.

This trend has much to do with college kids graduating into an environment where entry-level jobs are hard to come by. Additionally, many service industry jobs are usually performed by young adults, which are being greatly affected at this time. As the economy begins to rumble back to life, this trend will start to turn around. After all, unless you are recreating the iconic 2008 film Step Brothers, no one wants to live with their parents forever anyway. Due to inflationary factors and real estate prices, most of this age group will become renters before they move on to homeownership. We see this trend in our properties as most of our renters are in that age range. This shadow demand in the coming years will be an essential factor in the performance of our business.

We speak on and on about other potential economic factors. Unfortunately, the buying opportunities that everyone in the industry was talking about just never appeared. The buying comes from our continuous work to make something happen. The inflationary, migratory, and demographic factors will continue to support our business and backers. They continue to reinforce the strength of long-term cash.